Understanding contingency

Contingency means planning for unexpected events that might disrupt normal business operations. It involves thinking about what could go wrong and preparing ways to handle these situations. This planning helps businesses stay open and minimise problems when something unexpected happens, like a natural disaster, a system failure, or supply chain issues. By being prepared, businesses can quickly and effectively respond to crises, reducing the impact and ensuring they continue functioning.

What is a contingency?

A contingency is the potential occurrence of an adverse event in the future, such as an economic downturn, natural disaster, fraud, terrorist threat, or pandemic. While contingencies can be prepared for, predicting the exact nature or timing of such events is often impossible.

To manage these uncertainties, companies and investors develop contingency plans by analyzing potential risks and implementing protective strategies.

In finance, managers employ predictive models to identify and prepare for contingencies they consider likely. Financial managers generally take a conservative approach, planning for outcomes that may be slightly worse than expected to mitigate risk effectively. A solid contingency plan aims to position a company to endure negative events with minimal disruption.

Types of contingency plans

Contingency plans are essential strategies employed by corporations, governments, investors, and central banks, like the Federal Reserve, to prepare for unexpected events. These plans cover a wide range of potential disruptions, from real estate transactions and currency exchange fluctuations to geopolitical risks and commodities.

Protecting assets

Contingency plans often include provisions for contingent assets—benefits that may arise if certain favorable outcomes occur, such as winning a lawsuit or receiving an inheritance. Companies and individuals may also create contingencies by purchasing insurance policies to safeguard assets against potential losses.

Investment safeguards

Investors use contingency plans to manage potential financial losses through strategies like stop-loss orders, which exit positions at predefined price points to limit risk. Options strategies also function as a form of “insurance,” designed to offset losses from adverse market events. This approach involves buying options that generate returns as an asset’s value declines, partially or fully compensating for losses. While effective, these strategies come with a cost, typically in the form of premiums. Asset diversification, another contingency strategy, reduces risk by spreading investments across various asset classes, such as stocks and bonds, to mitigate losses if one category drops in value.

Contingent immunization

In fixed-income investing, contingent immunization acts as a contingency plan by allowing fund managers to adopt a defensive position if a portfolio’s value falls below a set threshold. This proactive approach helps protect investments from further losses during unfavorable market conditions.

Business continuity and recovery

To prepare for events like natural disasters or pandemics, companies implement contingency plans known as business continuity or recovery plans. These ensure the business can maintain operations during and after disruptive events. A dedicated continuity team typically manages this process, identifying critical business functions and analyzing the potential impact of disruptions on operations.

Cybersecurity measures

During crises, cyber threats can intensify, as cybercriminals exploit vulnerabilities within affected organizations. Contingency plans for cybersecurity outline steps to protect against malicious attacks and data breaches. These plans enable cybersecurity teams to respond swiftly, defending the organization’s digital assets and ensuring continued operations in the face of cyber threats.

Benefits of contingency planning

Ensures business continuity and resilience

A well-prepared contingency plan ensures that businesses can continue operations during disruptions. It provides a roadmap for responding to unexpected events, minimising their impact and ensuring continuity. This resilience is crucial for maintaining customer trust and satisfaction.

Minimises operational and financial disruptions

Contingency planning helps businesses minimise the operational and financial impact of disruptions. By having a plan in place, businesses can quickly respond to events, reducing downtime and financial losses. This proactive approach helps maintain stability and profitability.

Protects organisational assets and reputation

Effective contingency planning protects a company’s assets, including physical assets, data, and intellectual property. It also helps maintain the company’s reputation by ensuring that operations continue smoothly during disruptions. This protection is vital for long-term success and competitiveness.

How does contingency planning work?

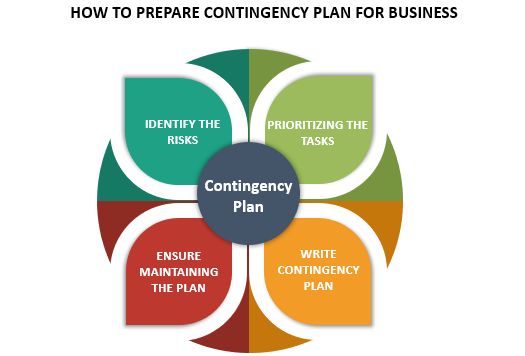

It works by preparing businesses for unexpected events that could disrupt operations. It involves these key steps:

Step 1. Identify potential risks

The first step in contingency planning is identifying potential risks that could affect the business. This involves brainstorming possible scenarios that could disrupt operations. These risks can be internal, such as IT failures or staff shortages, or external, such as natural disasters or supply chain disruptions. It’s essential to consider a wide range of potential risks to ensure comprehensive preparedness.

Step 2. Assess the impact of risks

Once potential risks are identified, the next step is to assess their impact on the business. This involves conducting a business impact analysis (BIA) to understand how different risks could affect various aspects of operations. The BIA helps prioritise risks based on their potential severity and likelihood. For example, a cyberattack might be assessed as having a high impact on IT infrastructure, while a natural disaster could severely disrupt physical operations.

Step 3. Develop response strategies

Businesses can develop response strategies after clearly understanding potential risks and their impacts. These strategies outline specific actions to take when a disruption occurs. Response strategies should be detailed and practical, including step-by-step instructions, assigned responsibilities, and communication protocols. For instance, in the event of an IT failure, the plan might include steps to switch to backup servers and notify affected stakeholders.

Step 4. Test and review the plan

A contingency plan is only effective if it is regularly tested and reviewed. Conducting regular drills and simulations helps ensure that the plan works as intended and that employees are familiar with their roles. Testing the plan can reveal weaknesses or gaps that need to be addressed. Additionally, the plan should be reviewed periodically to ensure it remains up-to-date and reflects any changes in the business environment or operations.

Putting your plan into action: Examples

IT disruptions

Businesses face significant risks from IT disruptions, such as cyberattacks, system failures, or data breaches. A contingency plan for IT disruptions should include strategies for data backup, system restoration, and cybersecurity measures. Ensure that critical data is regularly backed up and stored securely. Develop protocols for restoring systems quickly and effectively in case of a failure. Implement robust cybersecurity measures to protect against cyberattacks and data breaches.

Natural disasters

Natural disasters, such as earthquakes, floods, or hurricanes, can cause severe disruptions to business operations. A contingency plan for natural disasters should include strategies for protecting physical assets, ensuring employee safety, and maintaining operations. Identify safe locations for employees and establish communication protocols for emergencies. Develop plans for securing physical assets and minimising damage. Ensure that critical business functions can continue, either through remote work or alternative locations.

Supply chain disruptions

Supply chain disruptions can occur for various reasons, such as natural disasters, supplier issues, or logistical problems. A contingency plan for supply chain disruptions should include strategies for maintaining inventory levels and ensuring the continuity of supply. Identify secondary suppliers and establish relationships with them to provide a backup source of materials. Develop protocols for quickly switching suppliers in case of disruptions. Ensure that inventory levels are regularly monitored and maintained to prevent shortages.

Financial crises

Financial crises can result from economic downturns, market fluctuations, or internal financial mismanagement. A contingency plan for financial crises should include strategies for managing cash flow, securing financing, and reducing expenses. Develop protocols for monitoring cash flow and identifying potential financial risks. Establish relationships with financial institutions to secure funding if needed. Implement cost-saving measures to reduce expenses and maintain financial stability during crises.

Tips for effective contingency planning

Involving key stakeholders

Engage key stakeholders in the planning process to ensure all potential risks are identified and addressed. This collaboration brings diverse insights and enhances the plan’s comprehensiveness and acceptance.

Clear communication

Maintain clear communication throughout the planning and implementation stages. Ensure all team members understand their roles, responsibilities, and the steps to take during a disruption. Effective communication is crucial for coordinated responses.

Thorough documentation

Document the contingency plan in detail. Include step-by-step instructions, contact information, and resources. Well-documented plans ensure everyone knows what to do and can act quickly and efficiently.

Flexibility and adaptability

Ensure the contingency plan is flexible and adaptable to different scenarios. The ability to modify the plan in response to changing circumstances increases its effectiveness and relevance during actual disruptions.

Training and education

Provide regular training and education for employees on contingency procedures. Familiarity with the plan ensures that everyone can act quickly and correctly in a crisis.

Continuous improvement

Encourage a culture of continuous improvement. Regularly seek feedback from team members and stakeholders to identify areas for enhancement. This ongoing process helps refine and strengthen the contingency plan over time.

FAQs

What is contingency theory in business?

Contingency theory in business suggests that the best way to manage an organisation depends on various internal and external factors. There is no one-size-fits-all approach, and effective management practices vary based on the organization’s specific circumstances, such as its environment, size, and strategy.

What is contingency money?

Contingency money is a reserve fund set aside to cover unexpected expenses or emergencies. It acts as a financial safety net, helping individuals or businesses manage unforeseen costs without disrupting financial stability.

What does contingent mean?

Contingent means dependent on certain conditions or circumstances. For example, a contingent job offer is one that will only be finalised if certain conditions, like background checks or qualifications, are met.

What are contingencies?

Contingencies are potential events or situations that could occur in the future, typically requiring plans or measures to address them. These events can be positive or negative, such as emergencies, opportunities, or changes in circumstances.

What is an example of contingency management?

An example of contingency management is a company developing a backup plan for its supply chain. If a primary supplier fails, the company has alternative suppliers ready to ensure production continues without significant delays. This proactive planning helps maintain smooth operations during disruptions.