OneMoneyWay Corporate Mastercard

Simplify your company’s daily corporate expenses by accessing virtual and physical payment cards. Easily order and manage your cards online through OneMoneyWay’s user-friendly platform. Issued by B4B Payments.

- Order and manage your cards online

- Transparent pricing with no hidden charges

- Top up instantly

- Works globally

*Available soon to Denmark and Sweden, with more countries to follow.

Simplify expenses

An additional convenient way to make purchases

Amplify your company’s business account by adding a convenient avenue for purchases. Whether you’re covering travel expenses, web services, subscriptions, or other daily costs, accomplish it effortlessly with the OneMoneyWay Corporate Mastercard™.

Why OneMoneyWay?

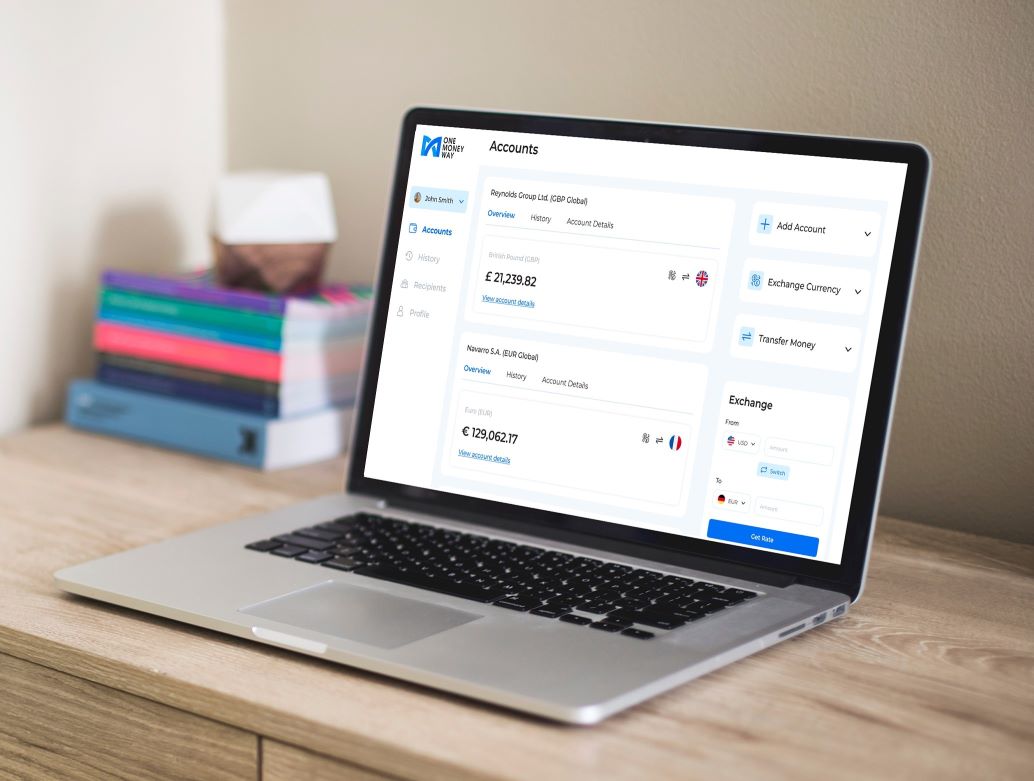

100% online

Order and manage online

Take charge of your corporate cards and employee expenses with ease. Issue, activate, top up, block, change PIN, and more – all under your control, any time of day.

Global access

Spend locally and globally

Experience the convenience of paying with a simple beep and swipe, plus make online purchases in any currency or global location where Mastercard is accepted.

What sets us apart?

Create multiple cards for different departments

Enhance your business flexibility with the ability to generate multiple cards for various departments, each tailored to specific needs and expenses.

Individual spending limits for each card

Maintain precise control over departmental expenditures by setting individual spending limits for each card, ensuring responsible financial management.

Track spending with categorization

Effortlessly monitor and categorize expenses, providing clarity and insight into your business’s financial transactions for streamlined accounting and reporting.

What sets us apart?

- Create multiple cards for different departments

Enhance your business flexibility with the ability to generate multiple cards for various departments, each tailored to specific needs and expenses.

- Individual spending limits for each card

Maintain precise control over departmental expenditures by setting individual spending limits for each card, ensuring responsible financial management.

- Track spending with categorization

Effortlessly monitor and categorize expenses, providing clarity and insight into your business’s financial transactions for streamlined accounting and reporting.

Virtual and Physical Cards

Choose the card that fits your business needs

Virtual, physical, or both – simplify expense management and financial tracking through OneMoneyWay’s intuitive platform. Effortlessly monitor transactions while focusing on business growth.

Physical Card

- 1-7 business days delivery

- Online & in-store payments

- ATM withdrawals

- Contactless payments

- Chip and magnetic stripe

Virtual Card

- Instant issue

- Online payments

What our clients are saying

Start your application in just 5 minutes

We serve businesses of all sizes and types. Begin with an application that understands your business requirements. After applying for a new account, our welcoming sales team will educate you in the compliance process that will be completed by our regulated partners professional compliance teams.

Application

Review

Confirmation

Start your application in just 5 minutes

We serve businesses of all sizes and types. Begin with an application that understands your business requirements. After applying for a new account, our welcoming sales team will educate you in the compliance process that will be completed by our regulated partners professional compliance teams.

Application

Review

Confirmation

Need a little more help?

Frequently asked questions

Is OneMoneyWay a bank?

OneMoneyWay is a payment and financial management platform. Although it is not a bank, OneMoneyWay provides a payment platform enabling companies to avail specific regulated services offered by our trusted partners. These services include business accounts, corporate cards, acquiring, currency conversion, SEPA, SWIFT, and more.

How long time does it take to open an account?

Usually, it takes 2-4 weeks after you have submitted relevant documentation for our partner’s professional compliance team to perform the review and open the account.

Is the account opening process remote?

Account opening with OneMoneyWay is 100% digital. You will be able to get your dedicated IBAN right after you pass the online onboarding. It can be done in 1 to 3 days after you’ve been approved by our partner’s compliance team.

Does my company have to be registered in Europe or the UK?

We can only provide access to our platform for companies registered in the European Union, EEA, and the United Kingdom.

What companies can you open accounts for?

We can accept 95% of all companies in a broad variety of different industries. If you are unsure whether we can take you in as a client, please sign up to speak with a representative who can share our and our partner’s risk appetite.

What is the price?

We take things like the type of business account and business needs into consideration when calculating your monthly fee. Contact a representative to hear about our pricing structure.

Who are OneMoneyWay’s partners and which financial services are they providing?

For Accounts, Payments, Cards and FX in EEA & the UK our Partner B4B Payments are powering every transaction.

https://www.b4bpayments.com/prepaid/

Payment Card Solutions (UK) Limited trading as B4B Payments is a financial technology company authorized by the Financial Conduct Authority to conduct electronic money service activities under the Electronic Money Regulations 2011 (Ref: 930619)

https://register.fca.org.uk/s/firm?id=0014G00002WxvxSQAR

UAB B4B Payments Europe is authorized by the Bank of Lithuania as an Electronic Money Institution (Licence No: 76) under the Law on Electronic Money and Electronic Money Institutions 2011.

https://www.lb.lt/lt/finansu-rinku-dalyviai/uab-b4b-payments-europe

For Card Acquiring Services in EEA and the UK our Partner Shift 4 is powering every transaction.

https://www.shift4.com/

Shift 4 is a trading name of CREDORAX BANK LIMITED, authorized as a credit institution by The Malta Financial Services Authority (MFSA) with MBR Registration Code C 46342

https://www.mfsa.mt/financial-services-register/

For Invoicing with Bankgiro and debt collection (for Swedish companies) our partner PayEx Sverige AB is powering every transaction. https://www.payex.com/

Location: Stockholm. Offices in Stockholm and Visby. Credit company that performs all financial services within PayEx. PayEx Sverige AB also offers invoice and Accounts Ledger services.

Through the Swedbank Pay business unit, PayEx Sverige AB offers network and mobile payments, payment terminals etc. PayEx debt collection and financial operations are conducted with authorisation from Finansinspektionen.

Which services are OneMoneyWay providing?

OneMoneyWay provides a digital platform where companies across Europe and the UK can access certain Financial Services provided by regulated partners. OneMoneyWay itself is not providing any regulated services.

How to complain?

All complaints regarding the platform or customer support must be directed to support@onemoneyway.com.

All complaints regarding the financial services must be directed to the Partner offering them.

If you have any other questions, please get in touch with our friendly team who will be able to help.