Open a Business Account in Denmark

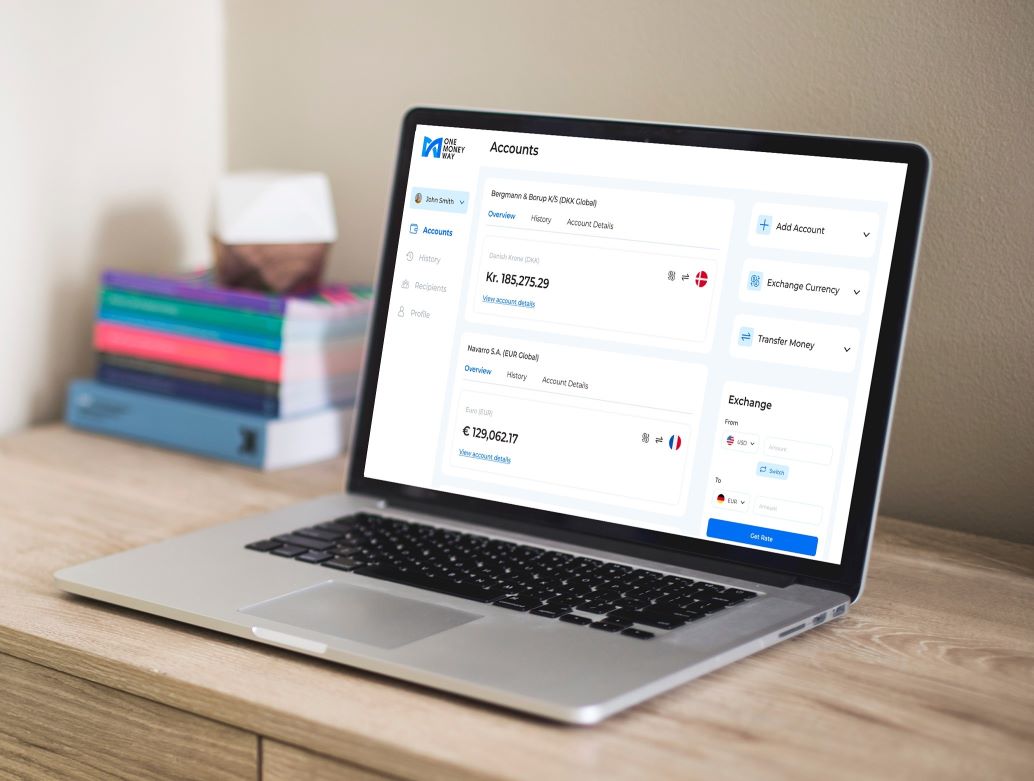

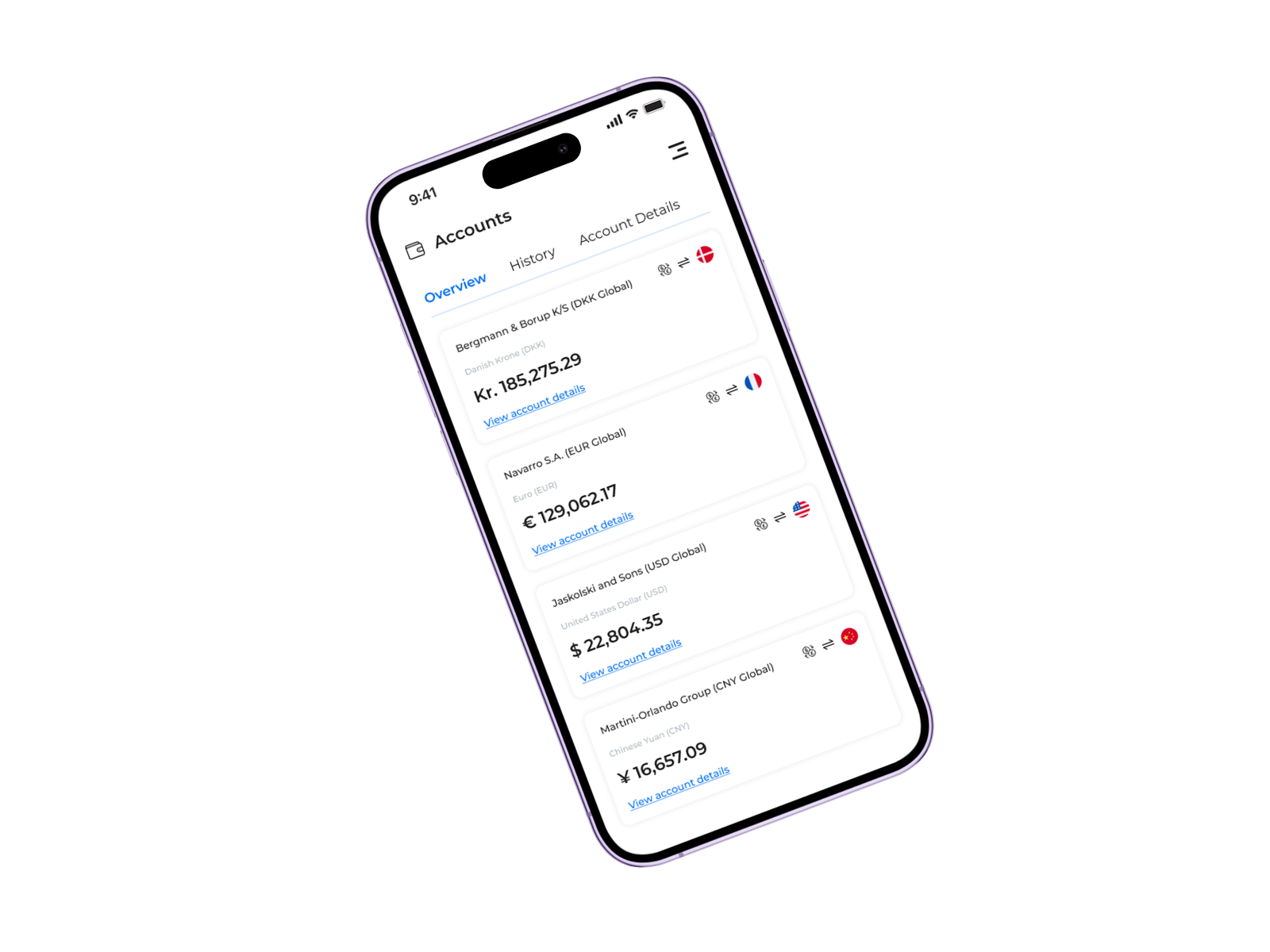

Get access to a Danish IBAN, account, and registration number under your company name. You can send, receive, or exchange your money, regardless of your location.

- Danish IBAN account and registration number

- No Danish residency requirements

- 100% online account registration

- Send, receive or exchange money in 24+ different currencies

Danish traditional banks can be challenging to deal with

Expensive fees and strict rules discourage non-residents and residents alike from local banking. OneMoneyWay is a financial management platform, simplifying DK access regardless of your passport. Our goal is to empower businesses to seize Denmark’s economic opportunities.

Why OneMoneyWay?

Minimize costs

Single account to manage local and global payments

Whether it’s local taxes, salaries, or expenses, having a dedicated business account streamlines international payments. Our platform supports all that an SME might need to operate a business in Denmark.

Make it global

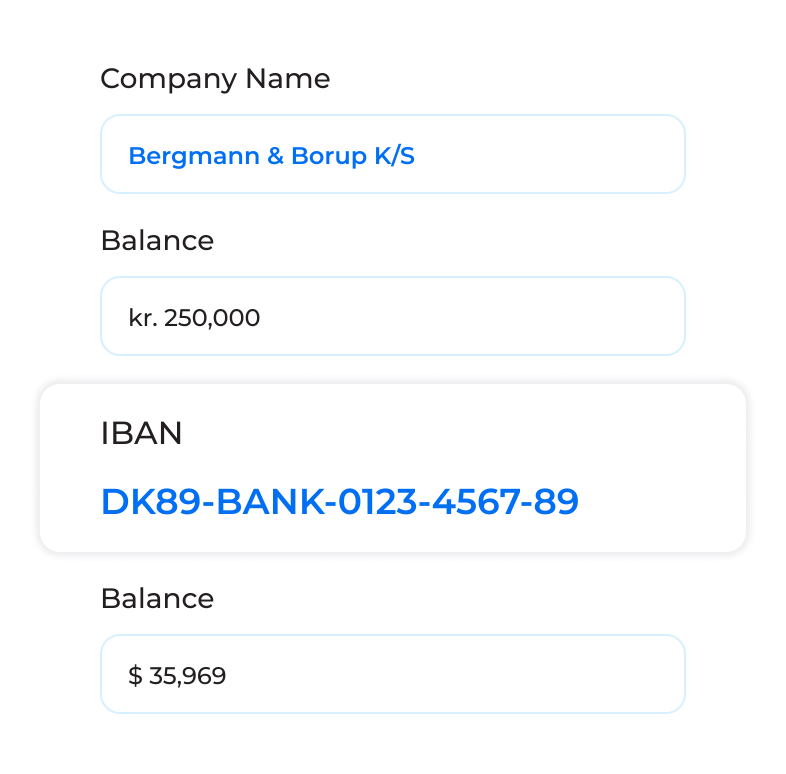

Get a Danish Business Account in your company name

Experience the advantages of a Danish business account without the hassle of paperwork. Your local DK IBAN account and reg.nr. provides you the means to function as a local business in Denmark.

Corporate Cards

Choose the card that fits your business needs

Amplify your company’s business capabilities by adding a convenient avenue for purchases. Whether you’re covering travel expenses, web services, subscriptions, or other daily costs, accomplish it effortlessly using the OneMoneyWay Corporate Mastercard™.

24/7 support

Dedicated account manager

Experience the ultimate support with your personal account manager and a dedicated support team, we are always at reach to support you through any account related process or complicated transaction.

What sets us apart?

Fast onboarding

Experience swift onboarding with OneMoneyWay’s user-friendly process. Get started without delays and access our platform’s benefits right away.

Top grade security

Your peace of mind matters. OneMoneyWay employs top grade security protocols to safeguard your financial transactions and sensitive data.

Low monthly fee

Enjoy our services without breaking the budget. OneMoneyWay offers a low monthly fee, ensuring value without compromise.

Invoicing module

Streamline your invoicing process with our integrated module. Easily manage and send invoices whilst focusing on your business growth.

What sets us apart?

- Fast onboarding

Experience swift onboarding with OneMoneyWay’s user-friendly process. Get started without delays and access our platform’s benefits right away.

- Top grade security

Your peace of mind matters. OneMoneyWay employs top grade security protocols to safeguard your financial transactions and sensitive data.

- Low monthly fee

Enjoy our services without breaking the budget. OneMoneyWay offers a low monthly fee, ensuring value without compromise.

- Invoicing module

Streamline your invoicing process with our integrated module. Easily manage and send invoices whilst focusing on your business growth.

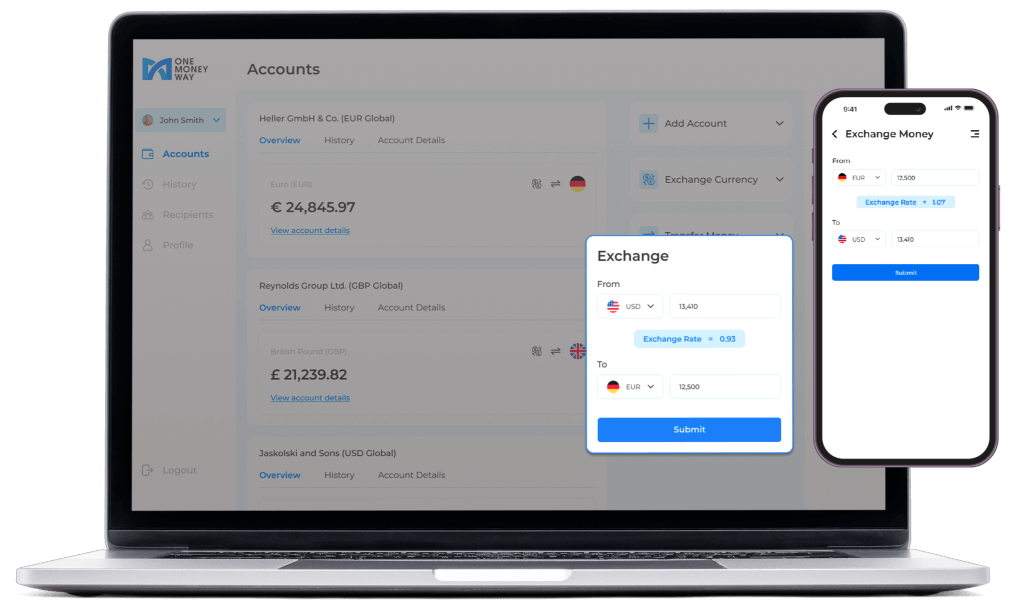

ForEx at your fingertips

Currency Exchange with no hidden fees

With OneMoneyWay, your company gains access to excellent exchange rates for 24+ different currencies offered by Partners. Enjoy the stability of Fixed Daily FX rates, ensuring you know what to expect. Seamlessly execute local and cross-border payments in all major currencies. Our platform gives you access to various payment methods, including SWIFT, SEPA, US ACH, Faster Payments, & DKK Payments. Say goodbye to hidden fees, embrace transparent & efficient currency exchange through our platform.

Low monthly fee

Account plans that scale with your business

Our commitment is to help small businesses save valuable time and resources. Get started with our starter business account, and select the plan that suits your needs. You can upgrade anytime as your business expands.

Starter

Maximum revenue

100,000 GBP

Billed annually

Up to 1 Business Account

Up to 1 Physical Mastercard

Up to 1 Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

Business

Maximum revenue

2,000,000 GBP

Billed annually

Up to 3 Business Accounts

Up to 2 Physical Mastercard

Up to 3 Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local Clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

Enterprise

Maximum revenue

Unlimited

(Contact us)

Unlimited Business Accounts

Unlimited Physical Mastercard

Unlimited Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local Clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

*Please note that our STARTER PLAN pricing may vary based on your specific risk profile and requirements.

Explore other markets

Get a local business account

OneMoneyWay is here to ensure that you establish a strong presence in every market, making you feel at home and empowered to conduct business wherever you choose.

Denmark

Get your local DKK account and embrace the opportunities Denmark has to offer.

Germany

Getting a local DE IBAN provides you the means to function as a local business in Germany.

Luxembourg

Experience the advantages of a Luxembourg business account without the hassle of paperwork.

Sweden

All the benefits of a local Sweden business account with no residency requirements.

United Kingdom

Get a local UK IBAN or a UK sort code and account number under your company name.

Low monthly fee

Account plans that scale with your business

Our commitment is to help small businesses save valuable time and resources. Get started with our starter business account, and select the plan that suits your needs. You can upgrade anytime as your business expands.

Starter

Maximum revenue

100,000 GBP

Billed annually

Up to 1 Business Account

Up to 1 Physical Mastercard

Up to 1 Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

Business

Maximum revenue

2,000,000 GBP

Billed annually

Up to 3 Business Accounts

Up to 2 Physical Mastercard

Up to 3 Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local Clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

Enterprise

Maximum revenue

Unlimited

(Contact us)

Unlimited Business Accounts

Unlimited Physical Mastercard

Unlimited Virtual Mastercard

Exchange between 24+ different currencies

Invoice Module

Local Clearing: DKK, SEPA, SWIFT, US ACH, Faster Payments

Danish account and REG.NR.

Dedicated Account Manager

*Please note that our STARTER PLAN pricing may vary based on your specific risk profile and requirements.

What our clients are saying

Start your application in just 5 minutes

We serve businesses of all sizes and types. Begin with an application that understands your business requirements. After applying for a new account, our welcoming sales team will educate you in the compliance process that will be completed by our regulated partners professional compliance teams.

Application

Review

Confirmation

Start your application in just 5 minutes

We serve businesses of all sizes and types. Begin with an application that understands your business requirements. After applying for a new account, our welcoming sales team will educate you in the compliance process that will be completed by our regulated partners professional compliance teams.

Application

Review

Confirmation

Need a little more help?

Frequently asked questions

Is OneMoneyWay a bank?

OneMoneyWay is a payment and financial management platform. Although it is not a bank, OneMoneyWay provides a payment platform enabling companies to avail specific regulated services offered by our trusted partners. These services include business accounts, corporate cards, acquiring, currency conversion, SEPA, SWIFT, and more.

How long time does it take to open an account?

Usually, it takes 2-4 weeks after you have submitted relevant documentation for our partner’s professional compliance team to perform the review and open the account.

Is the account opening process remote?

Account opening with OneMoneyWay is 100% digital. You will be able to get your dedicated IBAN right after you pass the online onboarding. It can be done in 1 to 3 days after you’ve been approved by our partner’s compliance team.

Does my company have to be registered in Europe or the UK?

We can only provide access to our platform for companies registered in the European Union, EEA, and the United Kingdom.

What companies can you open accounts for?

We can accept 95% of all companies in a broad variety of different industries. If you are unsure whether we can take you in as a client, please sign up to speak with a representative who can share our and our partner’s risk appetite.

What is the price?

We take things like the type of business account and business needs into consideration when calculating your monthly fee. Contact a representative to hear about our pricing structure.

Who are OneMoneyWay’s partners and which financial services are they providing?

For Accounts, Payments, Cards and FX in EEA & the UK our Partner B4B Payments are powering every transaction.

https://www.b4bpayments.com/prepaid/

Payment Card Solutions (UK) Limited trading as B4B Payments is a financial technology company authorized by the Financial Conduct Authority to conduct electronic money service activities under the Electronic Money Regulations 2011 (Ref: 930619)

https://register.fca.org.uk/s/firm?id=0014G00002WxvxSQAR

UAB B4B Payments Europe is authorized by the Bank of Lithuania as an Electronic Money Institution (Licence No: 76) under the Law on Electronic Money and Electronic Money Institutions 2011.

https://www.lb.lt/lt/finansu-rinku-dalyviai/uab-b4b-payments-europe

For Card Acquiring Services in EEA and the UK our Partner Shift 4 is powering every transaction.

https://www.shift4.com/

Shift 4 is a trading name of CREDORAX BANK LIMITED, authorized as a credit institution by The Malta Financial Services Authority (MFSA) with MBR Registration Code C 46342

https://www.mfsa.mt/financial-services-register/

For Invoicing with Bankgiro and debt collection (for Swedish companies) our partner PayEx Sverige AB is powering every transaction. https://www.payex.com/

Location: Stockholm. Offices in Stockholm and Visby. Credit company that performs all financial services within PayEx. PayEx Sverige AB also offers invoice and Accounts Ledger services.

Through the Swedbank Pay business unit, PayEx Sverige AB offers network and mobile payments, payment terminals etc. PayEx debt collection and financial operations are conducted with authorisation from Finansinspektionen.

Which services are OneMoneyWay providing?

OneMoneyWay provides a digital platform where companies across Europe and the UK can access certain Financial Services provided by regulated partners. OneMoneyWay itself is not providing any regulated services.

How to complain?

All complaints regarding the platform or customer support must be directed to support@onemoneyway.com.

All complaints regarding the financial services must be directed to the Partner offering them.

If you have any other questions, please get in touch with our friendly team who will be able to help.