How depreciation works in business: A complete guide to managing asset costs

Managing asset depreciation can seem complicated, but understanding it is essential for maintaining clear financial records and optimizing tax savings. It spreads the cost of an asset over its useful life, ensuring your finances accurately reflect its value. This systematic approach helps businesses avoid large, one-time expenses and aligns costs with the periods when the asset generates revenue.

For example, if you purchase equipment for your business, you don’t record the entire expense in one year. Instead, depreciation allows you to allocate a portion of the asset’s cost annually, keeping your financial statements balanced. Additionally, this process can reduce your taxable income, potentially saving you money during tax season.

Different methods of depreciation cater to various business needs. The straight-line method spreads the cost evenly over the asset’s lifespan, making it simple and predictable. Alternatively, accelerated methods, like the double-declining balance, allocate higher costs in the early years, benefiting businesses seeking greater tax deductions upfront.

Understanding and applying the right method ensures accurate financial reporting, helps you plan for future expenses, and makes tax compliance more manageable. By effectively managing this, businesses can maintain a clearer picture of their financial health and make informed decisions for long-term success.

What is depreciation?

This is a critical accounting concept that helps businesses manage the costs of long-term assets like machinery, vehicles, or buildings. Instead of recognizing the entire expense in the year the asset is purchased, depreciation allows the cost to be spread over its useful life. This method ensures that financial records remain balanced, as it matches the expense with the revenue the asset generates over time.

For example, if a business buys machinery for $50,000 and expects it to last for 10 years, it can allocate $5,000 per year as a depreciation expense. This gradual approach prevents a significant expense from skewing profits in the first year while providing a clearer view of ongoing operational costs.

Depreciation also plays a vital role in tax savings. By deducting a portion of the asset’s cost each year, businesses can reduce taxable income, easing the financial burden over time. Various methods, such as straight-line depreciation or accelerated depreciation, allow businesses to choose the approach that best fits their financial strategy.

By accurately tracking depreciation, businesses maintain more transparent financial records, comply with tax regulations, and make informed decisions about asset management and replacement, contributing to long-term stability and success.

Depreciation’s role in financial statements

For example, imagine you purchase a machine for $10,000 with a useful life of 10 years. Instead of deducting the entire $10,000 in the first year, you spread the cost over its lifespan by expensing $1,000 annually. This method helps stabilize your profits, making your financial statements more consistent and predictable.

Additionally, this gradual deduction provides tax benefits. By lowering your taxable income each year through depreciation, your business can retain more funds for operations or investments. This approach not only keeps your finances in order but also ensures compliance with tax regulations while maximizing long-term savings.

Impact on tax deductions

Depreciation plays a crucial role in managing your business’s financial health. On your income statement, depreciation reduces reported profit, reflecting the gradual expense of using an asset over time. This method ensures that your financial records more accurately represent the wear and tear on your assets, offering a clearer picture of operational costs.

Simultaneously, depreciation impacts the balance sheet by decreasing the value of the asset over its useful life. This systematic reduction aligns with the asset’s actual utility and helps avoid overstating its value in your financial reports.

A significant advantage of depreciation is its ability to manage tax obligations effectively. Instead of taking a single, large deduction in the year of purchase, depreciation spreads the cost across multiple years. This approach provides annual tax relief, which can ease cash flow and allow businesses to allocate resources more strategically.

Overall, depreciation is more than just a financial concept—it’s a tool for maintaining accurate financial records, optimizing tax savings, and aligning expenses with revenue generation. By leveraging depreciation correctly, businesses can achieve a balanced and sustainable financial strategy.

Types of depreciation methods

Different methods allow you to spread out an asset’s cost over time in various ways. The main methods are:

Straight-line depreciation: The most common method

Straight-line depreciation is the simplest way to spread out an asset’s cost evenly over its useful life. You take the total cost, subtract any expected salvage value, and divide it by the number of years you’ll use the asset.

Formula and example calculation

The formula is:

Depreciation Expense=(Cost-Salvage Value) / Useful Life

For example, a $20,000 machine expected to last 10 years with a $2,000 salvage value would depreciate by $1,800 each year.

When to use straight-line depreciation

This method is ideal for assets that provide steady value over time, like buildings or furniture. It’s predictable and easy to manage, making financial planning straightforward.

Declining balance depreciation: Accelerating depreciation

Declining balance depreciation allows you to write off more of an asset’s cost in the early years and less later on. It’s great for assets that lose value quickly, like technology or vehicles, where an early tax break is beneficial.

Formula and example calculation

The formula is:

Depreciation Expense=(2/Useful Life ) x (Book Value at the Beginning of the Year)

For a $15,000 computer with a 5-year life, first-year depreciation would be $6,000. The expense decreases each year as the book value drops.

When to use declining balance depreciation

This method is best for assets that depreciate fast, offering bigger tax savings early on. It’s useful for managing cash flow when assets quickly lose value.

Sum-of-the-years’ digits depreciation: A middle ground

The sum-of-the-years’ digits (SYD) method is a middle ground between straight-line and declining balance depreciation. It allows you to depreciate more of the asset’s cost in the earlier years, but not as rapidly as the declining balance method. It’s like a compromise—giving you a bit more upfront deduction without being too aggressive.

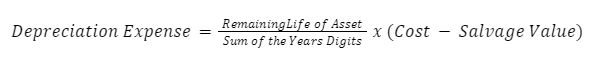

Formula and example calculation

Here’s how it works:

For example, if you buy a $10,000 machine with a 5-year life and expect to sell it for $1,000 at the end, the total of the years’ digits is 15 (5+4+3+2+1). In the first year, your depreciation would be $3,000.

When to use SYD depreciation

SYD is useful for assets that lose value faster in the early years, like vehicles or heavy machinery. It gives you a decent tax break upfront without going overboard, balancing your financial needs with sensible expense reporting.

Units of production depreciation: Usage-based depreciation

Units of production depreciation is like paying for what you use. The more you use the asset, the more you depreciate it. This method is perfect for equipment that gets wear and tear based on how much it’s used, like a factory machine.

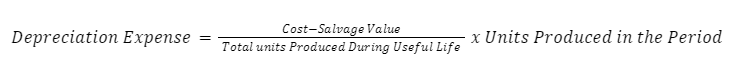

Formula and example calculation

The formula is:

Say you have a $20,000 machine with a $2,000 salvage value, expected to produce 100,000 units over its life. If it makes 10,000 units in a year, you’d depreciate $1,800 that year.

When to use units of production depreciation

This method works best for machines or equipment where the value depends on how much it’s used. It’s a precise way to match the cost of the asset with the actual benefit you’re getting from it, making your financial statements more accurate.

A quick comparison of different depreciation methods

| Depreciation method | How it works | Best for | Benefits | Drawbacks |

| Straight-line depreciation | Spreads cost evenly over the asset’s life. | Assets with consistent use and value. | Simple, predictable, and easy to manage. | Doesn’t match well with assets that lose value fast |

| Declining balance depreciation | Front-loads depreciation, more in early years. | Assets that lose value quickly (e.g., vehicles). | Larger early tax deductions, better cash flow early on. | Lower deductions in later years. |

| Sum-of-the-years’ digits (SYD) | Accelerates depreciation, a middle ground between methods. | Assets that wear out faster initially. | Balances higher early deductions with a slower pace. | More complex to calculate than straight-line. |

| Units of production depreciation | Ties depreciation to how much the asset is used. | Machinery or equipment with variable usage. | Matches expenses directly with usage, very accurate. | Requires tracking actual usage, can vary widely. |

Choosing the right method

The best method depends on your asset and what you’re trying to achieve. If you need predictability, straight-line is ideal. For early tax breaks, declining balance or SYD might be better. And if your asset’s usage varies, units of production could be the right fit.

Reporting depreciation on financial statements

Depreciation appears on both the income statement and the balance sheet. On the income statement, it’s recorded as an expense, reducing your net income. On the balance sheet, it reduces the book value of the asset over time, showing how the asset’s value decreases year by year.

Effect on the cash flow statement

Depreciation is a non-cash expense, meaning it doesn’t directly affect your cash flow. However, it’s added back to net income in the operating activities section of the cash flow statement, helping to reflect the actual cash generated by the business.

Depreciation vs. amortization

They both spread out the cost of assets, but they apply to different types. Depreciation is for tangible assets, like machinery or buildings, while amortization is for intangible assets, like patents or trademarks.

Both methods help businesses match the cost of these assets with the revenue they generate over time.

Their role in accounting

In business accounting, both depreciation and amortization reduce taxable income, but they affect different parts of the financial statements. Understanding when to use each is key to accurate financial reporting.

Depreciation and taxes: Maximizing benefits

Depreciation can have significant tax benefits. By reducing your taxable income, it lowers your overall tax liability. The key is to report depreciation correctly on your tax returns, ensuring you’re claiming the right amount each year.

How to report depreciation

Depreciation is typically reported on your tax return using IRS forms like Form 4562. It’s important to follow the IRS guidelines on the method and rate of depreciation to avoid penalties or audits.

Potential tax benefits

Depreciation allows for tax deductions over several years, rather than taking one large deduction in the year of purchase. This can help manage cash flow and reduce your tax burden over time, making it a powerful tool in tax planning.

Common depreciation mistakes to avoid

Misclassifying assets

One common mistake is categorizing assets incorrectly, leading to improper depreciation rates. This can distort your financial statements and result in compliance issues. Ensure that assets are properly classified based on their nature and expected useful life.

Using the wrong depreciation method

Another error is selecting a depreciation method that doesn’t match the asset’s usage or business needs. This can either overstate or understate expenses. Choose the method that best reflects how the asset’s value declines over time.

Ignoring salvage value

Some businesses forget to consider the salvage value, which can result in overstated depreciation. Always factor in the expected residual value of the asset at the end of its useful life to calculate accurate depreciation.

Wrapping up: Make depreciation work for your business

Depreciation is more than just numbers—it’s a handy tool for keeping your finances in check. By picking the right method and avoiding common mistakes, you can keep your books accurate and enjoy some tax perks. Getting depreciation right helps your business stay strong and financially smart.

FAQs

How is depreciation calculated?

Depreciation is calculated by spreading the cost of an asset over its useful life. You can use methods like straight-line, where you divide the cost evenly, or other methods that front-load the expense.

How to calculate the rate of depreciation?

To calculate the rate of depreciation, divide the annual depreciation expense by the asset’s total cost. For straight-line depreciation, it’s 1 divided by the asset’s useful life.

What is the entry for depreciation?

The entry for depreciation involves debiting Depreciation Expense and crediting Accumulated Depreciation. This reduces both the asset’s value on the balance sheet and the profit on the income statement.

Why is depreciation important?

Depreciation is important because it helps you match the cost of an asset with the revenue it generates, keeps your financial statements accurate, and offers tax benefits by lowering taxable income over time.

What is the difference between expenses and depreciation?

Expenses are costs that are used up within the year, like rent or utilities. It allocates the cost of a long-term asset across its useful lifespan, progressively accounting for the expense over multiple years.