Revolutionizing financial services in the digital age with fintech

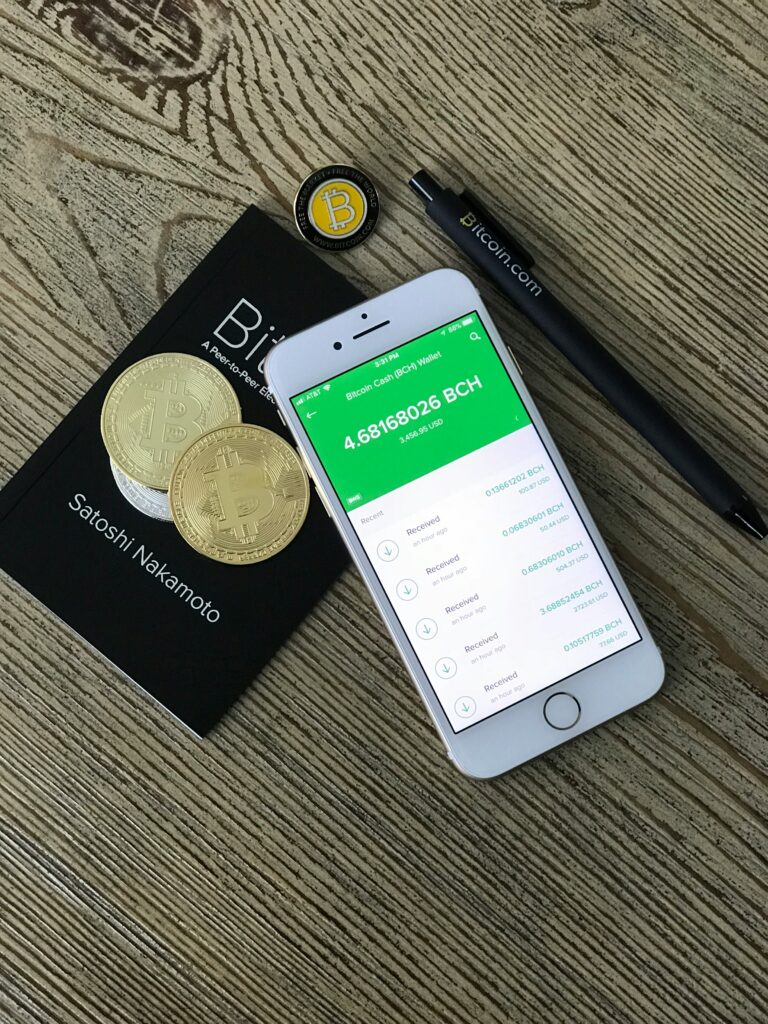

In today’s fast-paced digital world, “fintech” has become a game-changer by merging finance with technology. This combination, encapsulated in the term “fintech,” signifies a shift in the way financial services are delivered. Aiming to make them more accessible, efficient, and user-friendly. Fintech innovations span a broad range, from everyday conveniences like mobile banking and digital payments to cutting-edge advancements such as blockchain technology and robo-advisors. By leveraging technology, fintech companies simplify complex financial tasks, empower consumers with greater control over their finances, and enable businesses to offer streamlined, customer-centric services.

Definition and significance of fintech in modern finance

Fintech covers an extensive array of services tailored for both consumers and businesses, including digital banking, peer-to-peer lending, investment platforms, insurance technology (insurtech), and cryptocurrency. This diverse spectrum of services plays a crucial role in extending financial access to previously underserved populations, bridging gaps that traditional banking systems often leave unaddressed. Additionally, enhances global financial systems’ efficiency, reducing transaction times, costs, and barriers to entry. By embracing innovation, not only democratizes financial services but also optimizes processes across the industry, contributing to economic inclusivity and more resilient financial ecosystems worldwide.

Purpose and goals of fintech

Fintech’s core mission centers on making financial services more accessible, efficient, and innovative. By driving down costs and developing intuitive, user-friendly products, fintech meets the evolving demands of both businesses and consumers. This mission goes beyond convenience—it seeks to bridge gaps that traditional financial systems often overlook, providing solutions for underserved populations and enhancing the reach of financial services. Ultimately, fintech fosters a more inclusive and adaptable financial ecosystem, empowering individuals and businesses to manage their finances more effectively in today’s digital-first world.

The role of regulatory bodies in fintech

Danish Financial Supervisory Authority (DFSA)

In Denmark, the Danish Financial Supervisory Authority (DFSA) plays a critical role in shaping the landscape. Established to oversee and regulate financial markets and institutions, the DFSA ensures that financial entities operate within a secure and stable framework. By providing clear regulatory guidance, it supports a balanced environment where innovation in fintech can flourish without compromising consumer protection or market integrity. This proactive approach fosters trust in Denmark’s financial system, encouraging fintech growth while maintaining essential safeguards for both businesses and consumers.

DFSA overview and its financial sector role

The Danish Financial Supervisory Authority (DFSA) oversees Denmark’s financial markets, institutions, and insurance sectors, working to uphold stability and integrity across the financial landscape. Its regulatory framework protects consumers and investors by enforcing strict standards and promoting transparency. Additionally, by fostering fair competition and encouraging innovation, the DFSA creates an environment where companies can thrive, making Denmark an appealing hub for development. This supportive stance not only boosts Denmark’s fintech sector but also strengthens the country’s reputation as a leader in forward-thinking financial regulation.

DFSA goals and initiatives

The DFSA actively supports fintech startups by minimizing regulatory uncertainties and providing targeted assistance to promote growth. Key initiatives include:

- Clear regulatory guidance: By outlining compliance expectations, the DFSA reduces compliance risks, enabling startups to navigate regulatory requirements with confidence.

- Startup licensing support: Assisting new firms in meeting regulatory standards, the DFSA streamlines the process for gaining necessary approvals, helping startups launch more efficiently.

- Collaborative programs: Through the FT Lab (a regulatory sandbox) and the Forum, the DFSA offers a platform for experimentation and personalized guidance, fostering innovation while managing regulatory risks.

- International collaboration: By engaging with global regulators, the DFSA promotes cross-border fintech innovation, supporting Danish fintech companies in accessing international markets and encouraging knowledge exchange.

These initiatives create a supportive ecosystem for fintech, helping Denmark remain competitive and adaptable in the global fintech arena.

Fintech ecosystems and hubs

Copenhagen Fintech

Copenhagen Fintech is a vibrant ecosystem dedicated to positioning Copenhagen as a leading global hub. Its mission is to cultivate a dynamic and supportive environment where startups can flourish, driven by a focus on collaboration and innovation. By connecting startups with established financial institutions, tech firms, investors, and research communities, Copenhagen Fintech creates a solid foundation for advancements. This collaborative approach not only accelerates startup growth but also strengthens Copenhagen’s reputation as a hub for cutting-edge financial technology, attracting talent and investment from around the world.

Programs and events

Copenhagen Fintech provides a range of programs and events designed to fuel startup growth within the fintech sector:

- Fintech Lab: A collaborative co-working space offering essential resources, mentorship, and networking opportunities, creating a nurturing environment for early-stage startups.

- Accelerator programs: These programs provide intensive mentorship, funding access, and strategic partnerships, enabling startups to scale their operations and reach wider markets.

- Annual events: Conferences, workshops, and networking gatherings bring together industry leaders, startups, and investors, fostering connections that drive innovation and partnerships across the fintech ecosystem.

Through these initiatives, Copenhagen Fintech supports a robust infrastructure for startup growth, promoting Copenhagen as a vibrant fintech hub.

Partnerships and success stories

By collaborating with universities, financial institutions, and tech companies, Copenhagen Fintech facilitates knowledge sharing and drives innovation within the fintech ecosystem. These partnerships create a synergistic environment where ideas flourish, leading to the development of cutting-edge solutions and technologies. As a result, several notable fintech startups have emerged from this collaborative framework, showcasing the effectiveness of the ecosystem in nurturing and fostering fintech talent. This thriving network not only supports existing startups but also attracts new entrants to the market, solidifying Copenhagen’s position as a key player in the global fintech landscape.

Silicon Valley Denmark: A global perspective on Danish fintech

Silicon Valley Denmark connects Danish startups with global ecosystems. It leverages resources and expertise from Silicon Valley to help these startups grow internationally. This initiative focuses on driving advancements in key areas like blockchain, artificial intelligence, and digital payments. By fostering innovation and collaboration, it enhances the global competitiveness of Danish fintech. Startups benefit from mentorship, funding opportunities, and valuable networks. As a result, they can scale their operations and reach wider markets. Silicon Valley Denmark plays a crucial role in positioning Denmark as a significant player in the international fintech landscape.

Key fintech companies and their impact

Trifork

Trifork is a leader in fintech software development, known for its robust and scalable solutions across mobile banking, digital payments, and cybersecurity.

Case studies and future outlook

Trifork has demonstrated its expertise through successful projects that tackle complex challenges. The company has built a strong reputation for delivering innovative solutions. Looking ahead, Trifork is well-positioned to capitalize on emerging trends. Areas such as open banking, digital currency, and enhanced cybersecurity present significant opportunities. By focusing on these trends, Trifork aims to drive future innovations. The company plans to develop solutions that meet evolving market needs. This proactive approach will help Trifork stay competitive in the fast-paced fintech landscape. Overall, Trifork is ready to lead in the next wave of technological advancements.

Subaio: Collaboration for enhanced consumer services

Subaio specializes in subscription management and collaborates with banks to assist consumers in managing their subscriptions effectively. This partnership simplifies the process for users, allowing them to track and control their recurring payments easily. Collaborations between fintech companies and banks, like the one with Subaio, are crucial for expanding the reach of fintech solutions. These partnerships enhance the accessibility of innovative services, ultimately increasing the societal impact of fintech. By integrating subscription management into traditional banking platforms, consumers can benefit from improved financial oversight and better control over their spending habits. This synergy helps drive adoption and fosters a more financially literate society.

Fintech-bank partnership models

Different partnership structures, including strategic alliances and technology integrations, enable firms to access new markets and broaden their offerings effectively. Strategic alliances involve collaboration between companies to achieve common goals while maintaining their independence. This type of partnership allows businesses to combine their strengths, share resources, and leverage each other’s expertise. On the other hand, technology integrations focus on merging systems or platforms, facilitating seamless operations and enhanced service delivery. By adopting these partnership models, firms can innovate, improve their competitive edge, and cater to a wider audience. These collaborations not only foster growth but also drive efficiency, allowing companies to respond swiftly to changing market demands and consumer needs. Overall, such partnerships are essential for companies aiming to thrive in today’s dynamic business landscape.

Academic perspectives on fintech

Copenhagen Business School (CBS)

Copenhagen Business School (CBS) provides valuable insights into the growth of fintech, particularly in emerging markets. Through its extensive research, CBS highlights key drivers of fintech adoption, including increasing internet connectivity, the widespread use of smartphones, and the emergence of a growing middle class. These factors create an environment conducive to the uptake of digital financial services, enabling more individuals and businesses to access financial products that were previously unavailable. CBS’s analysis emphasizes how these developments contribute to financial inclusion, allowing underserved populations to participate in the economy. By understanding these trends, stakeholders can better navigate the fintech landscape and capitalize on opportunities for growth in emerging markets.

Fintech’s impact on financial inclusion

Fintech plays a crucial role in promoting financial inclusion by making affordable financial services accessible in underserved regions. Research conducted by Copenhagen Business School (CBS) highlights how fintech innovations, such as mobile banking and microfinance, are effectively bridging gaps in financial access. Mobile banking allows users to perform transactions using their smartphones, eliminating the need for physical bank branches, which can be scarce in remote areas. Additionally, microfinance offers small loans to individuals and small businesses that traditional banks often overlook, empowering them to invest in opportunities that can improve their livelihoods. By leveraging technology, fintech solutions are breaking down barriers to financial services, enabling a broader segment of the population to participate in the economy, save, and invest for the future. This transformative impact underscores the importance of fintech in creating a more inclusive financial landscape.

Regulatory challenges and future outlook

In emerging markets, fintech faces unique regulatory challenges, particularly the need to balance innovation with consumer protection. Research from Copenhagen Business School (CBS) provides valuable insights into these issues, offering solutions and best practices that can foster sustainable growth in the fintech sector. By examining various case studies, CBS illustrates how fintech initiatives are driving economic development across the globe. These studies highlight successful approaches to regulation that not only encourage innovation but also safeguard consumers’ interests. For instance, establishing clear guidelines and frameworks can help fintech companies operate confidently while ensuring that consumer rights are upheld. Moreover, fostering collaboration between regulators and fintech firms can lead to the creation of adaptable policies that support technological advancements while prioritizing consumer safety. Such strategies are essential for building a robust fintech ecosystem that contributes to economic progress in emerging markets, ultimately improving financial inclusion and stability for underserved populations.

The future of fintech: Key trends and challenges

KPMG insights

KPMG identifies significant trends that will shape fintech, such as blockchain, AI, and machine learning, which are expected to revolutionize business models, customer experiences, and operational efficiency.

Regulatory environment and market analysis

As fintech evolves, regulatory bodies are adapting to ensure these innovations are secure. KPMG’s analysis stresses the need for balanced regulatory frameworks to protect consumers while encouraging innovation.

Future challenges and opportunities

Although fintech offers immense potential, it faces challenges like cyber security threats and regulatory compliance. Nonetheless, its capacity to enhance financial inclusion and efficiency makes an attractive sector for growth and investment.

FAQs about fintech

What is fintech?

Fintech, short for financial technology, refers to technology-driven solutions designed to improve and automate financial services.

How does fintech benefit consumers?

By making financial services accessible, affordable, and user-friendly, fintech caters to evolving consumer and business needs, driving financial inclusion.

What role do regulatory bodies play?

Regulatory bodies, such as the DFSA, help ensure fintech companies operate within a stable framework, fostering innovation while protecting consumers.

What are some examples of popular fintech applications?

Popular fintech applications include mobile payment solutions (e.g., Apple Pay, Google Wallet), peer-to-peer lending platforms (e.g., LendingClub), digital investment tools (e.g., Robinhood), and robo-advisors for automated investment management (e.g., Betterment). These apps enhance convenience, streamline financial processes, and offer new ways to manage money and investments.

How does fintech impact traditional financial institutions?

Fintech disrupts traditional financial institutions by offering faster, more user-friendly alternatives to traditional banking and investment services. This competition drives banks to innovate, often partnering with companies or adopting similar technologies to improve customer experiences. Additionally, fintech can reduce operational costs for banks by automating processes, making financial services more accessible and efficient.